vatreturn

- Home

- vatreturn

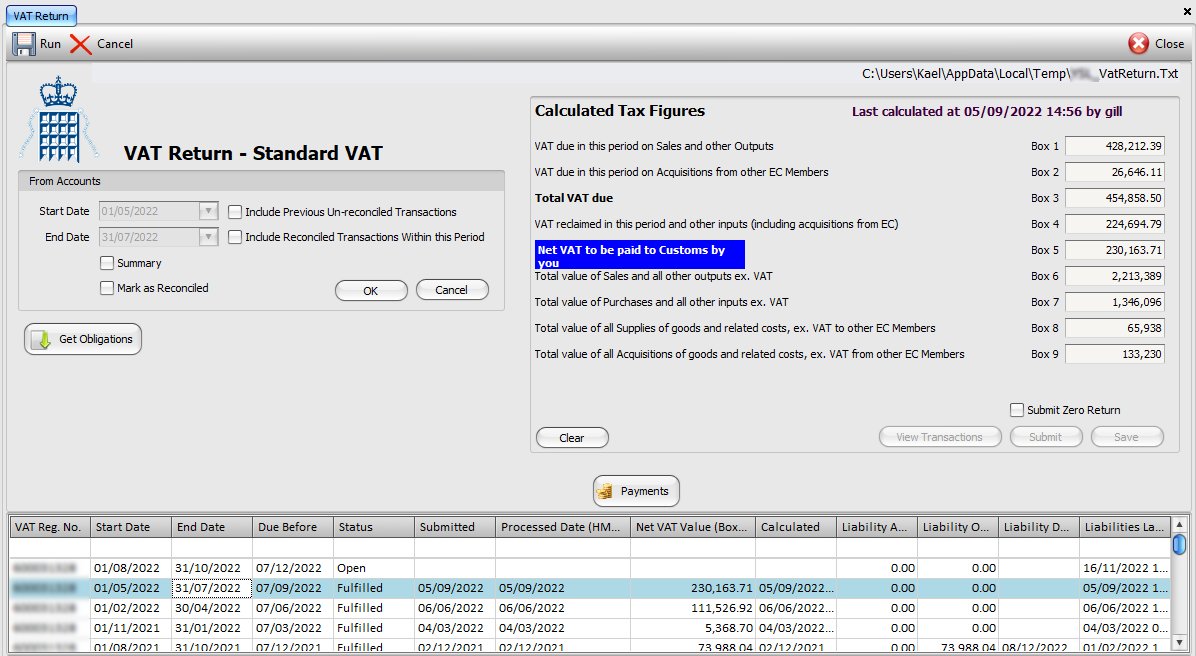

VAT Return

VAT Return

1. Authorisation

Before you can submit your VAT return to HMRC, you have to have let HMRC know that you wish to submit your VAT returns using Ice Ledger. You can start this process this by clicking on the button, Authorise. A new screen will direct you to the HMRC portal where you will need to log into your HMRC government gateway. Simply follow the onscreen instructions to allow Ice Ledger authorisation. Once the Authorisation process has been completed, you will need to ‘Get Obligations’ to allow your installation of Ice Ledger to be able to connect to HMRC. For more details see MTD – Making Tax Digital.

2. VAT Scheme

Based on your VAT registration, you may calculate your VAT return based on figures from sales and purchase invoices (Standard VAT scheme) or on monies spent / received (Cash Accounting) or you may be on a Flat Rate Scheme, based on your business industry. Please make sure you have the correct VAT scheme selected in system configurations (Settings / Configurations / Company / Details).

3. Start & End Dates

To process your VAT return, simply set the correct start and end dates for your VAT return period and click OK to calculate the figures for your return. Summary VAT Return figures are shown on the screen, to the right and a print dialogue screen is presented to enable you to print the VAT report. It is IMPORTANT that you produce a full VAT report to check that return figures that are calculated are derived from correct entries; make sure there are no errors or omissions (see 6 and 7, below).

4. Include Previous Un-reconciled Transactions

Occasionally you may find that after you have completed your VAT return, you have transactions for this period that were not on the system. In which case, on your next VAT return, these will be shown as old transactions (i.e. before your new VAT return period) that have been un-reconciled and should be included in your now current VAT retrun. Simply check this box to include these transactions.

5. Include Reconciled Transactions Within this Period

Occasionally you may find that you have accidentally marked some transactions, within the current VAT return period, as reconciled before you have done your actual VAT return report. If this is the case, you can include these transaction by placing a tick in this box.

6. Summary

Before submitting your VAT return, it is recommended that you untick this Summary box to produce a detailed VAT report that you can then check to make sure that all the data entries are correct and that there are no errors, omissions or entries that should not be included.

7. Calculated Tax Figures

This section displays the date & time and the logged-in user ID when the VAT return report was generated, above the actual summary VAT return figures. If there is any VAT to be paid to HMRC (Box 5) then this entry (Net VAT to be paid to Customs by you) will be highlighted in blue. However, if you are due any VAT back from HMRC then this entry will be shown in Green and will be titled: Net VAT to be claimed from Customs.

If you are registered for or want to submit your VAT returns using the HMRC new digital platform (Making Tax Digital) the please read the guide, MTD – Making Tax Digital.

8. Mark as Reconciled

When you submit your VAT on line, the associated transactions are automatically marked as reconciled to prevent them being included in future submissions. In addition, you can tick this option and run the report, by clicking the OK button, for a given period to mark those transactions as being reconcelled without having to make a VAT submission. You do not have to print the report for the transactions to be marked as reconciled.

9. Zero Return

If for any reason you have a zero VAT to be submitted, you can do so by clicking the check box, Submit Zero Return before submitting.

10. View Previously Submitted VAT Transactions

Click on the appropriate record in the list of previously submitted VAT returns, at the bottom of the screen. This will automatically set the period start and end dates to the selected period and display the submitted figures on screen, in the Calculated Tax Figures section. You can now click on the button, View Transactions to view / print all the transactions that were used to prepare the VAT return.